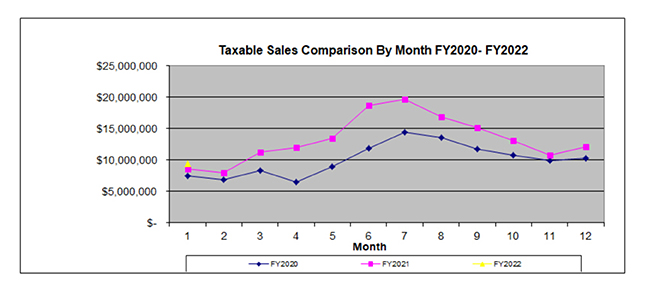

Manitou Springs’ taxable sales totaled $9,447,509 in January, a steady climb from the $8,579,237 in January 2021 and $7,496,477 in January 2020.

In December 2021, 157 businesses reported their sales; in January 2022, that totaled 121.

The Colorado Department of Revenue provides the statistics, which are based on sales tax data.

Some sales categories showed improvement over the same timeframe in 2021. They are: Shops/Gifts/Etc., with taxable sales of $1,209,637 for a 2.7 percent gain; Other in City, which includes the marijuana outlets, with taxable sales of $3,527,628 for an 18.9 percent increase; and Motels/B&Bs, with $890,331 in sales for a whopping 71.2 increase.

Marijuana sales are taxed at 11.4 percent, compared to the 3.9 percent tax on other types of businesses. The state could break out a new statistical category for marijuana if Manitou ever adds a third store.

Categories still struggling to recover from the pandemic are: Amusements/Bars, which earned $238,301 for a 17.1 percent decrease compared to January 2021; Stores/Food/Gas, which earned $122,786 for a drop of 27.1 percent; and Restaurants, which earned $601,839 for a decrease of 4.6 percent.

Sales tax distribution is $576,031 to the General Fund, $33,794 to the Urban Renewal Authority, $8,895 to the Open Space Fund and $26,686 to the Manitou Arts, Culture, and Heritage Fund.

Sales tax is by far the largest contributor to the city’s all-purpose General Fund.

Vendors report and remit taxes in the month after the reporting period. Some report quarterly and some annually, causing some distortion of the statistics.